can dogs have health insurance: advanced considerations and real-world fit

Yes. Dogs can be insured, but the product is pet health insurance, and it works differently from human plans. You usually pay the vet first, then get reimbursed after a claim review. That reimbursement model drives most of the practical choices you'll make.

What "health insurance" means for dogs

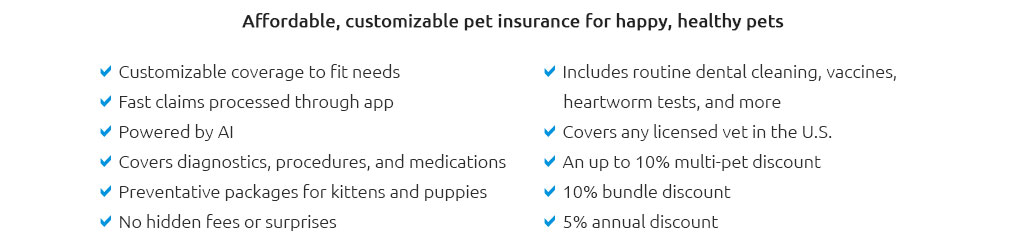

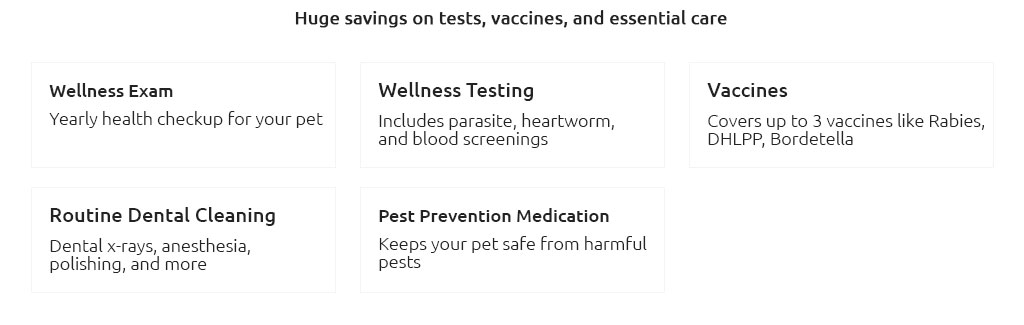

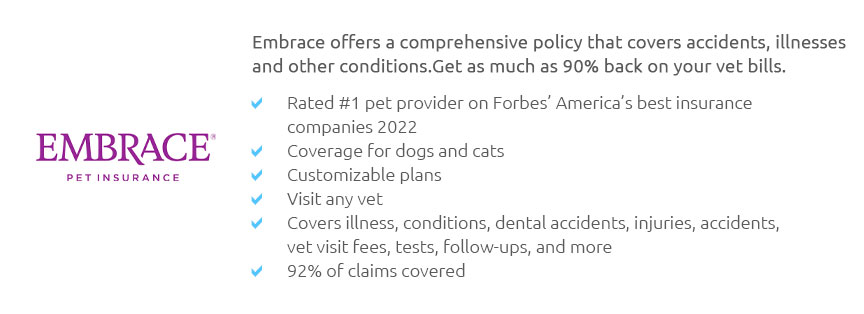

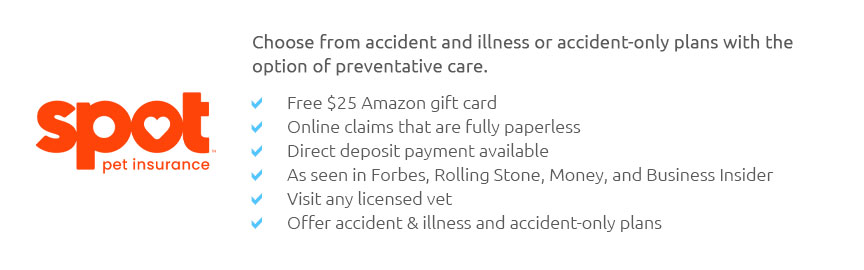

Policies cover accidents only or accidents plus illnesses, sometimes with optional wellness add-ons. Any licensed veterinarian is typically fine - no strict networks. Big surgeries may allow pre-approval to reduce uncertainty, but you still need cash or credit at the time of treatment. Managing liquidity is part of being covered.

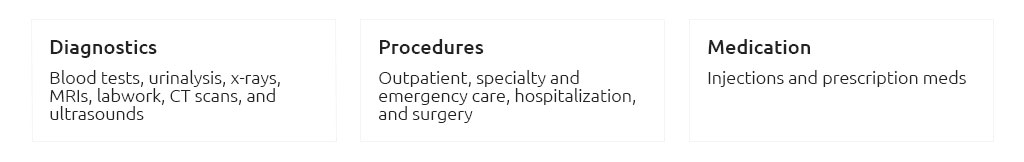

Key coverage components to verify

- Scope: Accident-only vs comprehensive illness; cancer, hereditary, and congenital conditions.

- Deductible design: Annual vs per-incident. Annual is simpler for chronic issues; per-incident can get costly if multiple unrelated problems arise.

- Reimbursement: Commonly 70 - 90%. Higher percentages raise premiums.

- Annual limits: From $5k caps to unlimited. Caps matter with specialty care or cancer protocols.

- Waiting periods: Accidents may be near-immediate to 5 days; illnesses often 14 - 30 days; cruciate/hip dysplasia can be 6 - 12 months unless specifically waived.

- Exclusions: Pre-existing conditions, bilateral clauses (e.g., one torn cruciate excludes the other), breeding, cosmetic, some behavioral or experimental treatments.

- Dental: Injury is usually covered; dental illness is policy-specific. Periodontal disease is often excluded.

- Meds and rehab: Prescription drugs, PT/rehab, acupuncture/laser vary by plan. Read the fine print.

Costs and what drives them

Premiums vary by breed, age, and ZIP code. A young mixed-breed in a smaller market might be $25 - $45/month for solid coverage; a large purebred in a big city can run $80 - $150+. Prices rise over time as pets age and vet costs inflate. High deductibles and lower reimbursement can reduce premiums, but underinsuring a high-risk breed is a false economy.

Risk-aware selection steps

- Define your ceiling for one-time emergencies and ongoing care. Be honest about cash flow vs credit.

- Collect sample policies and the full specimen contract - do not rely on brochures.

- Search for definitions that matter: "pre-existing," "curable," "bilateral," "usual and customary."

- Ask about orthopedic exam waivers and specific wait-period exceptions in writing.

- Check claim processing times, direct-pay options for ER/specialty, and any app-only hurdles.

- Confirm enrollment age limits and lifetime renewability if you enroll young.

- Note how and when premiums can change; find the cancellation and appeals process.

- Document your dog's baseline with a vet exam before enrolling to avoid ambiguity.

Claim experience: a quiet 2 a.m. example

The lab mix swallows a sock. ER visit. Abdominal imaging, endoscopy. Bill: $2,400. You pay then submit a claim in the app. Policy is 80% reimbursement with a $500 annual deductible. If the deductible hasn't been met, the rough math: $2,400 − $500 = $1,900; 80% = $1,520 back, typically within a week - faster with direct deposit. Line-item exclusions (exam fees, non-covered supplies) can trim this. If a "foreign body" was noted before enrollment, coverage could be denied. Paperwork and records matter.

Subtleties people miss

- Bilateral clauses: One knee today can void coverage on the other if not disclosed or if the clause is strict.

- Chronic conditions: Confirm they're covered year to year if you keep the policy active.

- Dental nuance: Trauma vs disease is treated differently; cleanings are wellness, not illness.

- Cancer protocols: Chemo/immunotherapy often covered, but staging tests and specialty consults can hit caps.

- Prescription diets: Commonly excluded even when medically indicated.

- Timing: Insure early. A "symptom noted" before enrollment can label the entire condition pre-existing.

Where it may not fit

Very senior dogs may face enrollment limits or premium spikes that outpace expected claims. If you maintain a robust emergency fund and accept volatility, disciplined self-insurance can work. Still, catastrophic events - GDV, spinal surgery, immune-mediated disease - can exceed a comfortable cash reserve.

Brief pause: picture your dog at the ER door. What would you want already decided?

Practical checklist

- Enroll before problems start; keep records clean and centralized.

- Choose annual deductible if you worry about multi-issue years.

- Target at least 80% reimbursement or unlimited annual limit if specialty care access is a priority.

- Photograph invoices and submit claims same day; track reimbursements.

- Review policy annually; adjust as age, breed risk, and finances change.

Bottom line

Yes, dogs can have health insurance. It's reimbursement-based, exclusion-driven, and sensitive to timing. For a risk-averse owner, early enrollment, careful reading of exclusions, and realistic budgeting for premium increases create the best real-world fit - and fewer surprises on the worst day.